After months of community skepticism and scrutiny, BitConnect is closing its doors. The popular Bitcoin investment platform has long come under fire for its dubious business model, promises of daily 1% returns on investment, and lack of team transparency. Some have even branded the project as a scam, likening it a textbook ponzi scheme.

BitConnect really seems like a scam. an old school ponzi … bad actors hurt the community. period. #bitcoin #ether

— Mike Novogratz (@novogratz) November 30, 2017

I've been asked what I think about BitConnect. From the surface, seems like a classic ponzi scheme. I wouldn't invest in it and wouldn't recommend anyone else to.

I follow this rule of thumb:

"If it looks like a 🦆, walks like a 🦆, and quacks like a 🦆, then it's a ponzi." 😂

— Charlie Lee Ⓜ️🕸️ (@SatoshiLite) November 30, 2017

Pulling an Exit Scam?

EDIT: Since publishing, BitConnect has removed the mentioned blog post from their website.

A recent blog post on the BitConnect website, which “inform[s] all community members that [team members] are closing the Bitconnect [sic] lending and exchange platform,” may confirm these long-held suspicions. The write-up outlines the specifics of the service’s termination:

“We are closing the lending operation immediately with the release of all outstanding loans. With [sic] release of your entire active loan in the lending wallet we are transferring all your lending wallet balance to your BitConnect wallet balance at 363.62 USD. This rate has been calculated based on last 15 days averages of the closing price registered on coinmarketcap.com. You are free to withdraw your BitConnect coin currently in QT wallets that was used for staking as well. We are also closing BCC exchange platform in 5 days.”

While lending will cease immediately, followed by a closure of BitConnect’s exchange in five days, the “BitConnect.co website will operate for wallet service, news and educational purposes,” the post reveals.

The team continues to offer three distinct explanations driving their decision to nix the company’s hallmark platforms. One such reason includes a slew of “bad press” that “has made community members uneasy and created a lack of confidence in the platform.”

This bad press was born from three separate cease and desist orders from the UK government, the North Carolina Securities Division, and the Texas State Securities Board. BitConnect sites the latter two in their second explanation, arguing that these developments created “a hindrance for the legal continuation of the platform.”

Finally, the company also argues that a series of distributed denial of service (DDoS) attacks “have made the platform unstable and have created more panic inside the community.”

https://twitter.com/bitconnect/status/952239982135169024?ref_src=twsrc%5Etfw&ref_url=https%3A%2F%2Fthenextweb.com%2Fhardfork%2F2018%2F01%2F16%2Fbitconnect-promoters-sever-downtime%2F

Strangely, even with the cessation of its lending and exchange platforms, BitConnect “will [not] stop supporting BitConnect coin.” With its exchange and lending services kaput, BitConnect’s coin loses all practical functionality, but the team hopes for “Bitconnect to be listed on outside exchanges giving more options for trading.”

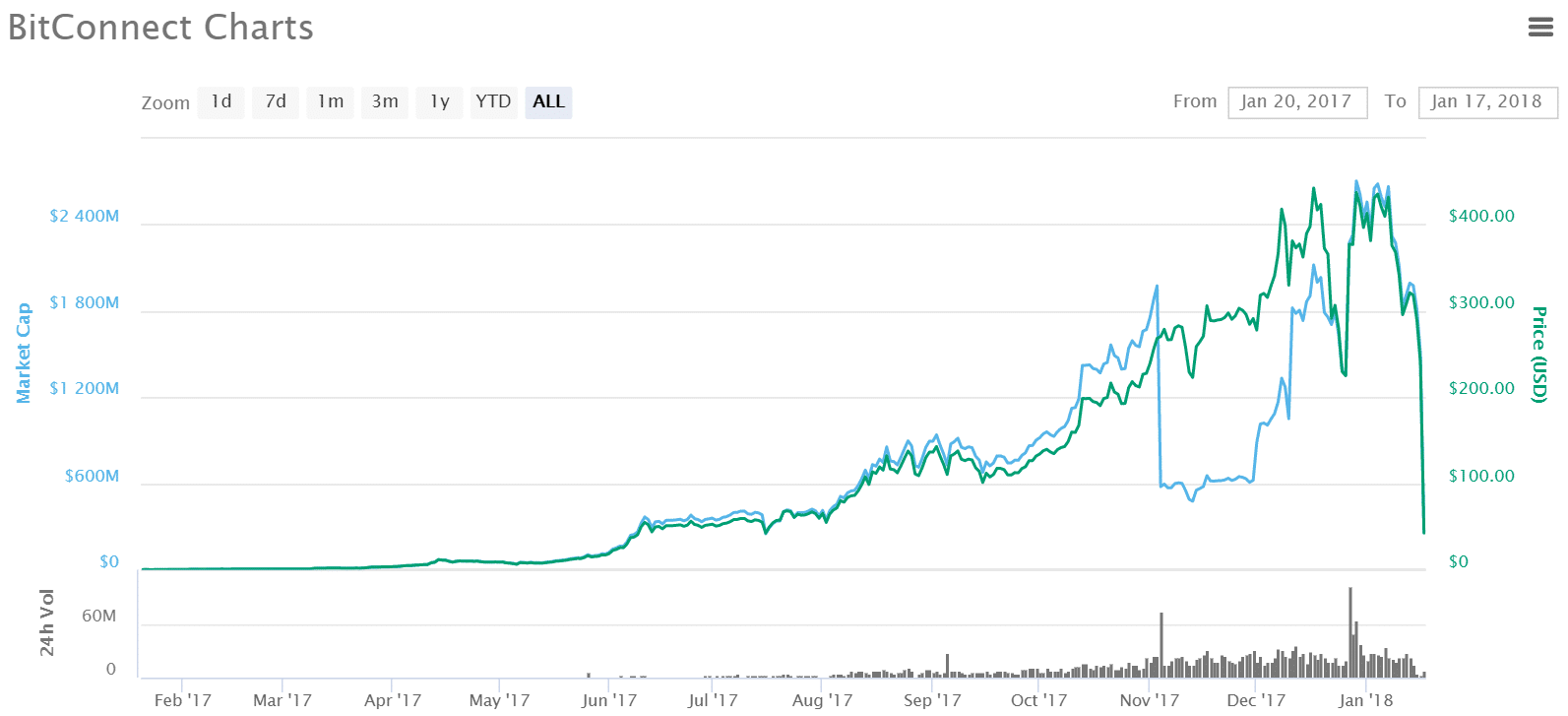

Following the announcement, BitConnect plummeted in price on CoinMarketCap. At press time, its current price sits at $43.83.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.